Financial Literacy 101

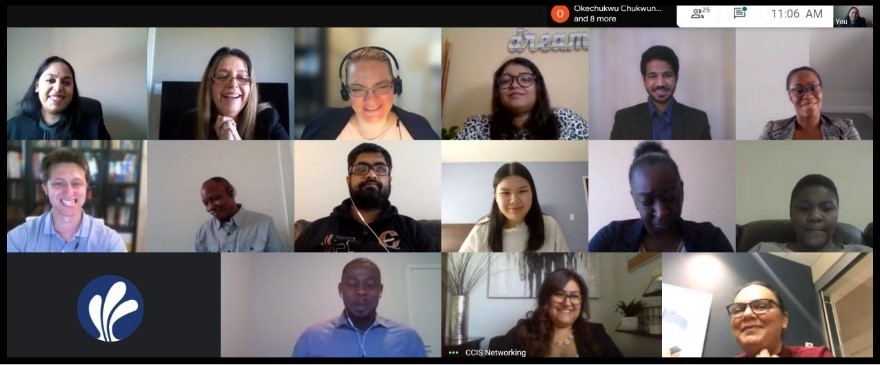

PANELISTS:

- Patricia Martinez – Financial Advisor, Edward Jones

- Jodie Moffatt – Financial Empowerment Facilitator, Momentum

- Hoda Ahmadi - Regional Sales Director Specialized Networks- Mortgage Development at National Bank of Canada (Alberta)

- Dan Arciaga, Banking Advisor, National Bank of Canada

- Nazia Zeb-Sharif, Mortgage Development Manager, National Bank of Canada

Financial products and services have become more widely available in society in recent years. Credit products such as credit cards, mortgages, and student loans have grown in popularity, as have other investment products such as health insurance and self-directed investment accounts. This has made it imperative for people to understand how to use them responsibly.

Although numerous skills can be classified as financial literacy, some everyday examples include household budgeting, learning how to manage and pay off debts, and evaluating the trade-offs between credit and investment products.

The lack of financial literacy can lead to pitfalls one may never be able to recover from. Financially illiterate individuals are more prone to accumulating unsustainable debt burdens that can lead to poor credit, bankruptcy, housing foreclosure, and many other negative consequences. Given the importance of finance in modern society, a lack of financial literacy can be extremely detrimental to a person's long-term financial success.

Results from the 2019 survey by the Canadian Financial Capability Survey indicate that nearly three-quarters of Canadians (73.2%) have some type of outstanding debt or used a payday loan at some point over the past 12 months (see also Statistics Canada, 2017). Almost one third (31%) believe they have too much debt.

Source: https://www.canada.ca/en/financial-consumer-agency/programs/research/canadian-financial-capability-survey-2019.html

Fortunately, there are now more resources than ever for those wishing to educate themselves about the world of finance.

Our panelists from the banking sector educated our clients from the very basics of budgeting to different ways to save tax and also about mortgages for first-time homebuyers. Post the event, the clients feel relieved about financial methodologies in Canada.

By accepting you will be accessing a service provided by a third-party external to https://networkingyouth.ccislive.ca/